“Twenty years from now you will be more disappointed by the things that you didn’t do than by the ones you did do. So throw off the bowlines. Sail away from the safe harbor. Catch the trade winds in your sails. Explore. Dream. Discover.” —Attributed to Mark Twain

Do these words stir a fire deep within you, awakening a spirit of wanderlust and travel? Maybe you were a gypsy, vagabond or hobo in a past life, but you think you could never afford to live the life of freedom you long for? It could be you are a survivalist, or just want to drop out of society but don’t know how. Perhaps you are just sick of the rat race and want to simplify your life. Or possibly the bad economy of the last few years have left you with no choice but move into a car, van or RV?

We have good news for you, you can, and this site is here to show you how! The key is eliminating the single highest expense most of us have, our housing. We will do that by moving into our vehicle and “boondocking.” By that I mean living in your vehicle without paying for a campsite.

“You’ve got a lot of choices. If getting out of bed in the morning is a chore and you’re not smiling on a regular basis, try another choice”. —Steven D. Woodhull

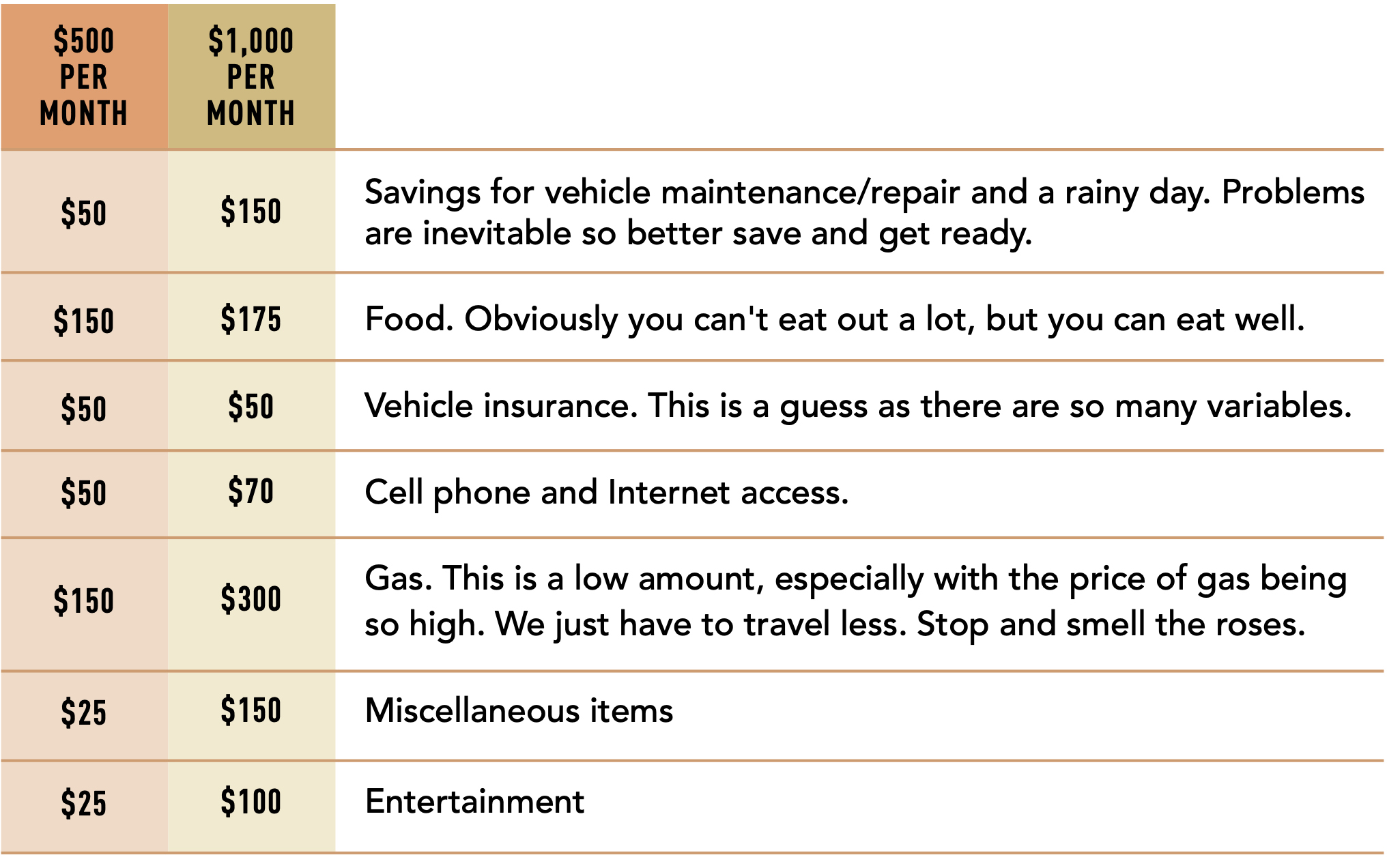

People say to me all the time, “But how can I afford to live in a van and travel all the time?” My answer is aways, “How can you afford not to?!” Let me prove to you right off the bat that you can live the free life. Here is a budget showing just how little money you need to live and travel full time. One column is for a $500 a month and the other is for $1,000 a month.

Of course, at $500 per month this is a sparse life, but I am just showing you that it can be done. In fact I personally know dozens of people who live in their vans and make much less than $1,000 per month, so I know for a fact that it can, and is, being done right now. That still leaves us with the question, where will the money come from? Let me show you some simple strategies for living the cheap RV lifestyle.

1) Move Into Your Vehicle and Save your Rent/House Payment

You are probably working at a job right now and paying for an apartment or house. The first thing you do is decide what type of vehicle you want to live in and purchase it. Then you have a garage sale and sell as much of your excess stuff as you can, and give the rest away. Then you move into your vehicle. Now this is very important, you open a savings account and the money you used to pay to your landLORD for your apartment or house payment (including the utilities) you start paying to yourself instead by putting the payments into the savings account instead. Now you alone are the LORD of your life! The hardest part is that it will soon turn into a lot of money and you will be tempted to spend it. Don’t do it! Leave it there unless it is a total emergency. If you are currently paying $600 a month for rent and utilities, then at the end of the year you will have saved $7,200. Now you can travel for the next 7-14 months without working. Or if you work intermittently, you can extend that even further.

2) Alternate Work and Travel

So, we take our $7200 and leave on our new life of freedom until we need more money. Then, we choose a place we want to be for a while, stop there, and get a job paying as much as we can, but at least $7 per hour . For that month we take home about $1000. We spend half of that to live on, and now have $500 in savings. Actually, we should have more since we won’t be driving much (some of us will ride our bike, scooter or motorcycle which we are carrying on a bike rack or trailer). So we can take that $500 and are off again. Or we can spend several months at one place and then travel several months. Maybe you like to ski so you spend three months at a ski resort working and skiing on the weekends. Then you have the next three months off to do whatever and go wherever you want. When you need to work again, you drive up to Glacier National Park and get a job there doing dishes at the resort. You spend your summer weekends hiking and taking pictures. Three months later, you are free again. Or maybe you are a history buff. So you drive to Gettysburg and get a job there. You spend your weekends exploring the Amish country and Philadelphia. You then go to New England to photograph the fall colors and spend a month exploring Washington DC. When you need to work again you drive to Orlando or Miami, get a job, and explore Florida. If you are adventurous you can work your way down to a beach resort in Mexico where you work for the next three months and surf, fish and snorkel on your weekends. Working in the tourist industry you probably double your wage in tips and living in Mexico is very cheap so you save even more than usual. Now you can take the next six months off in the U.S., or maybe nine months off in Mexico. You keep doing this to your heart’s content!

3) Live on a Pension

Or maybe you are like me. I took early retirement with a pension of about $1100 per month and I don’t have to work at all unless I want to for whatever reason. I am young and healthy so I am working as a campground host in some beautiful places. That way I can build more of a savings account or spend more as I want. Many people have social security or disability checks they live on.

4) Work While You Travel

With a little creativity you can find ways to make money while you travel. The possibilities here are endless, only limited by your abilities and imagination. With access to the Internet, many traditional jobs can be done remotely as you travel. Here are some possibilities but they are just to jump-start your thinking. There are many books and websites with a huge selection of ideas:

-

-

- Work Camp as a campground host

- Make crafts and sell them

- Buy and sell on Ebay

- Create works of art and sell them

- Handyman services

- House painting

- Animal grooming

- Auto detailing

- Knife Sharpening

- Web Site, YouTube and other social media

- Photography

- Sewing

- Accounting

-

This life can be for you if you want it! We have shown that you can live on very little, and four ways to make the little money you do need. So what is holding you back? For most of us it is fear. Let’s address that and show you a simple strategy to overcome your fears.

“I will not die an unlived life.

I will not live in fear

of falling or catching fire.

I choose to inhabit my days,

to allow my living to open me,

to make me less afraid,

more accessible;

to loosen my heart

until it becomes a wing,

a torch, a promise.”

—Dawna Markova

Overcoming our fears

This is a tough one. Many of us live lives of quiet desperation, hating our jobs, and just enduring our life. We meet our obligations and conform to societies dictates. On the surface, all looks good. But on the inside is a desperate but muffled cry for a life of passion, adventure and travel. Summed up in one word it is a cry for FREEDOM!! This is probably overstating it, but if you look at your life, you can probably find some element of it in there. What holds us back? Why can’t we break out of our rut into a new and exciting life? For most of us it is fear. We have an unconscious fear that “An unpleasant but acceptable present is better than an unknown and dangerous future.” So, how do you overcome your fears? Allow me to lead you through an exercise to overcome a fear.

The first and hardest step is to take an unflinching look at ourselves and identify the fears that hold us back. I’m going to list a few possibilities, but remember this is just a starting place, you must do the hard work of finding your own fears.

-

-

- Fear of going broke and being homeless and penniless.

- Fear of being alone and lonely.

- Fear for my physical safety

- Fear of failure.

- Fear that I’m not good enough.

- Fear of what others will think.

- Fear of the unknown.

- Fear that I’m Too Young

-

After you have identified your fears, accept them, even embrace them; they are a natural instinct given to us to keep us safe and from taking stupid risks. They are a good thing unless we let them paralyze us. When that feeling of fear and panic starts to well up from your gut, take a really deep breath and literally thank it for the wise warning it’s offering you. Then assure it you will consider the warning very seriously. This may seem very “new-agy” but try it any way.

Next, address the fears and find solutions. There are solutions to every problem! On this page we have presented a solution to one of our biggest fears: that we will run out of money and be indigent. We’ve seen just how little we need live on and how to make the money we need.

But reading about it won’t ally your fears, you have to take steps so start right now doing your homework:

- Record all your expenses so you know where your money is going.

- Decide what is really important and spend your money only on those things.

- Write up a detailed budget and follow it, or do something simple like at the beginning of every month put cash in envelopes for each category of spending.

- Start researching new ways to make money

- Increase your work skills and gather the necessary tools for an on-the-road job.

Now, when that fear wells up again, gratefully embrace it and say, “Thank you for the warning, but this is a safe risk. Look at my budget. Here is my savings account for emergencies. This is how I will make more money. Everything will be alright,” You may have to do this many times, but eventually your fear will turn to hope as it embraces your new life. Then, come, and join us as we travel the road of carefree destiny.

A livable vehicle is the biggest obstacle.

When I started living in a vehicle it was a dodge Dakota crew cab. I removed the back seats and put a flat wooden platform with a foam mattress. It was comfortable for a whole year when I camped and mountain biked 95% of the weekends, leaving in the San Jose arear in California.

I am 6′ tall and eventually my knees couldn’t take it anymore as I couldn’t sleep with my legs stretched. lol, looking back now I wonder how I did it. At that time I was working and had a storage place for my stuff.

As my knees where asking for more space, I got a dodge ProMaster high top. Wow… what a mansion, lol. Yes, having that much space makes all the diference. But if I was shorter and my knees didn’t complain, I would keep going with the truck. It was paid for, good gas mileage and would take me to places that I now can not go with the van. But it is all good, I still have the freedom to go where my van can take me.

I love this life!!!

My anchor is my precious mother of 95 years. She is healthy, takes No Medication. Able to walk without cane or walker. She lives on her own, but needs me to shop, run errands and basically help with everyday obsticals. Mainly cell phone. I so despirately want to leave. My husband before he passed 2 years ago spent 6 years traveling in our rv. Loved the life. Boondocking in Quartzite, Imperial Dam and Gila Bend. So for those that have the option…GET OUT THERE and GOD BLESS

Where are your favorite spots places to bike?

My fear is I’m too old…77 healthy male. Live on a tight budget and have to work PT. Social is 1534/mo. Have a paid for dodge caravan in good condition and a small house I could sell for a profit. Just afraid I’m too old. Get my medical thru the VA.

Love your info. Saw you in the movie. You’re doing great work.

Joe Lowery

Joe, if you’re in good health, then you’re not too old. I know several nomads your age or older, and I’m only a handful of years younger than you. How do you want to spend the rest of your life?

You could take short trips.

I’m 60 and was thinking I was to old.My mind says I’m never to old but I have R/A. The way I feel don’t think about it just try it.

I myself am in a tough spot I live in a house in palm beach county fl,and it’s being foreclosed on!! ,the sale is April7Omg I’m in trouble,!I’ve lived in my suv. For a year,it’s just to small,and ,omg hot here in Florida,so months ago I started buying and saving bought a new generator. 12v 100ah lifpo4 battery, 32 quart freezer__fridge, was all I can do i spent a small fortune putting on a hitch ,for a. 7 x 10 enclosed cargo trailer, but I swear every time I call the company’s back the prices have changed so much it unbelievable…. They tell me on the phone it’s such and such and my fear is I will drive 2 hours and the trailer won’t even be there…does any one have any trailer people that won’t rip me off, I HAVE FINALLY MANAGED TO PUT ENOUGH AWAY FOR A SOLID 25 PERCENT DEPOSIT, FOR MY BAD CREDIT

Find a place you can make monthly payments on one. I’m making monthly payments on a one buy here pay here.its mine in 2 or less years. $300 a month.

My camper is 40 foot long.my air keeps shutting off so I bought air conditioner I put in the window run it off a different extension cord have had not problems with it..

Lots of good info. I want more.

Hello this is kinda of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding skills so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!

This site is built with WordPress and Divi.

Al, are you the webmaster?

It’s sort of shared duty between me and a tech guy.

Do you see anyone living full time in a pop up camper? I have a nice one that is full functional but I boondock in it most of the time. It’s easy to set up & light weight to tow. Im sure this would add expense but not much.

I have seen several fulltimers in pop-ups.

My son gave his pop up to a lady who now lives and works in a TexasState park in that pop up. I live in my rv at a rv park where I work In The office. I have fears about not having money for a new one but I deal with it and save money.

I love this. All of this. See you out there!

Trust us all when we say your a lottery winner ,set your self free ,just be aware of your limitations, what I mean is physically,don’t put yourself in harm’s way untill you feel comfortable WITH it

CAN ANY ONE HELP ME WITH THE STRESS OF Handing OVER 2000.00. OF MY MONEY AND GETTING JUNK FROM A NEW TRAILER DEALER ,AND THE FACT THAT I HAVE TO FIND A PLACE IN SUCH A SEMI URBAN. AREA TO DO THE BUILDS ON IT. IN STORAGE,,I HAVE CALLED SO MANY PLACES , EITHER YOU CANT WORK ON IT , ON THERE. PROPERTIES OR THERE JUST TOO EXPENSIVE TO STORE IT. THERE ,BETWEEN THE PAYMENT ON THE STORAGE AND THE TRAILER IS CLOSE TO 500. MONTHLY, THIS IS PALM BEACH COUNTY FLORIDA,AND I’M TIED HERE BECAUSE OF MY DOCTORS,FOR. THE NEXT 8 MONTHS, and no home to live I,,But I LIKE THE IDEA OF SEEING THE WHOLE STATE. FROM KEY WEST TO JACKSONVILLE AND THE

Would be an interesting gambit, perhaps. But then there’s the details, like if you are (or wanna be) a ‘digital nomad’, how do you hook that up? What’s the best cell phone booster? Satellite service link? How much does that cost per month if you have to live on your SS out here in the boonies? Internet access for your bank account?

“Best” depends upon a number of things. If you search the Knowledge Base (the Learn button on the top menu) or just use the regular search button, there are several articles on the topic.

There are ways to get wifi almost anywhere. I was doing copywriting part time and went to MacDonalds to submit my work and invoices.

What is link to buy land between williams and flagstaff

You might find what you want googling “cheap land grand canyon junction.”